- EUR/USD staged a solid recovery on Tuesday on broad-based USD weakness.

- The optimism turned out to be short-lived amid renewed coronavirus worries.

- Reviving safe-haven demand underpinned the USD and exerted some pressure.

The US dollar witnessed some aggressive long-unwinding trade on Tuesday and allowed the EUR/USD pair to stage a goodish recovery from near two-week lows set in the previous session. The global equity markets enjoyed a second day of strong gains on Tuesday amid signs that the coronavirus pandemic may be reaching its peak in Europe and the United States. The risk-on mood dented the greenback’s perceived safe-haven status against its European counterpart and was seen as one of the key factors behind the pair’s goodish intraday positive move of around 140 pips.

The pair rallied to three-day tops, albeit struggled to find acceptance above the 1.0900 round-figure mark. The overnight optimism turned out to be short-lived amid increasing numbers of fatalities from the COVID-19 pandemic and forced investors to take refuge in the traditional safe-haven currencies. This comes on the back of growing concerns over the negative economic effects of the coronavirus crisis, which should continue to benefit the USD’s status as the global reserve currency and keep a lid on any meaningful positive move for the major, at least for now.

Apart from the overall coronavirus pandemic situation, investors on Wednesday will further take cues from the release of the FOMC meeting minutes. In the absence of any major market-moving economic releases from the Eurozone, the pair remains at the mercy of the USD price dynamics and the broader market risk sentiment.

Short-term technical outlook

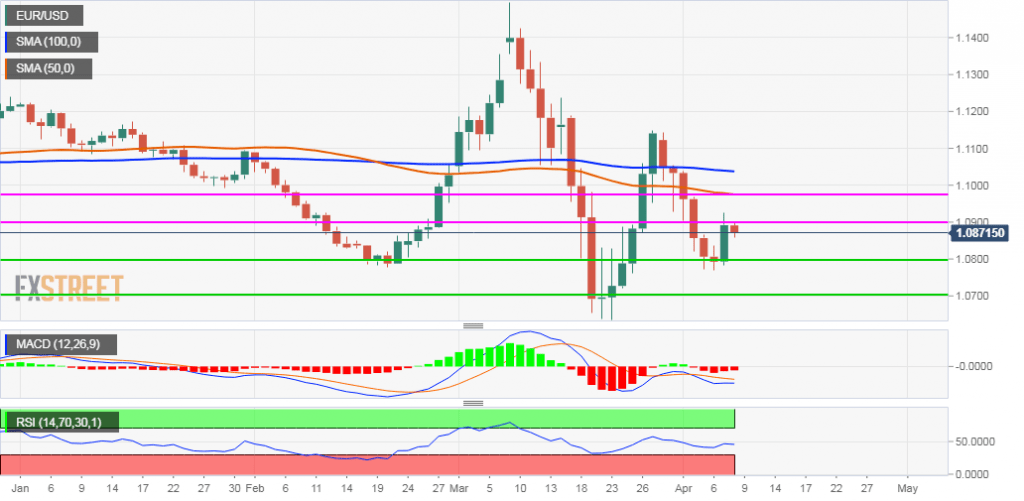

From a technical perspective, the pair’s inability to capitalize on the attempted recovery move points to persistent selling bias at higher levels. Hence, the near-term bias remains tilted in favour of bearish traders. Meanwhile, immediate support is pegged near the 1.0835-30 region and is followed by the 1.0800 round-figure mark. Failure to defend the mentioned handle might turn the pair vulnerable to slide further below weekly lows, around the 1.0770-65 region, towards challenging the 1.0700 round-figure mark.

On the flip side, the 1.0900 mark now seems to act as an immediate resistance, above which a bout of short-covering has the potential to lift the pair further towards 50-day SMA hurdle, near the 1.0975 region. The momentum could further get extended towards the key 1.10 psychological mark en-route 100-day SMA, currently near the 1.1035 region.