Show navigationFXStreet

Valeria Bednarik

FXStreet Follow

EUR/USD Forecast: Corrective rebound doesn’t change the doom picture

ANALYSIS | Published Mar 27, 2020 15:40 (+00:00)

- Coronavirus crisis continues to take its toll on global economic developments.

- US employment sector in the spotlight in the form of Nonfarm Payroll report.

- EUR/USD recovered from a fresh 2-year low, the risk still skewed to the downside.

The EUR/USD pair has staged a substantial recovery this past week, recovering toward the 1.1000 price zone after falling to 1.0635 at the beginning of the week, its lowest since April 2017. Fear kept the dollar fueled throughout the first half of the week, amid the exponential coronavirus expansion. As days go by and the crisis extends, more countries enter lockdown further halting economic activity worldwide.

Recession is among us

The US may already be in recession, according to the US Federal Reserve’s Head, Jerome Powell. He quick-started the week by announcing the largest-ever easing package of the central bank’s history, unlimited Treasuries buying and mortgage-backed securities. In an interview on Thursday, Powell said that the central bank would expand easing if necessary. He also added that he expects economic activity to resume in the second half of the year, an optimistic view that not everyone shares.

The ECB, while more conservative, also took some bold measures these last few days. It announced through a legal document released on Thursday that the limit to a third of each of its member states’ debit, should not apply when buying bonds within its relief program. The European Central Bank is also engaged in providing liquidity to keep economies afloat. Budget debt limits are being removed through the Union.

Further, and after almost a week of discussions, US senators passed a massive $2T relief package, meant to cope with the effects of the coronavirus pandemic on the economy. The Senate approved the bill in a unanimous 96-0 vote, while the House is expected to approve it ahead of Monday.

Demand for the American currency receded, equities bounced, but the world is not out of the woods yet. As said, the coronavirus outbreak continues to expand and taking its death toll. Uncertainty on when and in what shape the world will return to normal persists. With that in mind, a steeper dollar’s decline seems unlikely.

Things are worse than anticipated

According to Markit, the services sector is the one most hit with the ongoing crisis. The preliminary estimates of March PMI for most economies plummeted to record lows. Manufacturing output also contracted in most economies, although at a slower pace.

Consumer confidence sinks globally, with the German IFO Business Climate down to 86.1 and the GFK Consumer Confidence in the country for April down to 2.7. In the US, the Michigan Consumer Sentiment Index was downwardly revised to 89.1 in March’s final reading from 101 in February. Sub-components of the report show that the Current Economic Conditions Index dropped to 103.7 from 114.8 and the Index of Consumer Expectations fell to 79.7 from 92.1.

The most outrageous figure, which anyway failed to impact markets, as unemployment claims in the US that jumped to 3.28 million in the week ended March 20. The limited reaction could be explained but the fact that many US states changed the rules on who is entitled to ask for it, amid the coronavirus crisis forcing workers to stay at home. Nevertheless, its clearly hinting more dark clouds ahead for the world’s largest economy.

The next few days, post-crisis data will start appearing and could be a first indicator of the coronavirus’ economic damage. The EU Consumer Confidence index for March will be out next Monday, while the Union and Germany will release March preliminary inflation estimates at the beginning of the week. Markit will release the final version of its March Manufacturing and Services PMI next Wednesday, while the US will publish the official ISM index, much more relevant. This last is foreseen at 44 from 50.1 previously.

US employment data will be among the hottest. The ADP survey on jobs’ creation in the private sector will be out next Wednesday and is expected to show 150,000 fewer jobs. It may also hint what the Nonfarm Payroll report could bring at the end of the week. At this point, the US economy is expected to have lost 293K jobs in March, while the unemployment rate is seen up to 4.0%.

EUR/USD technical outlook

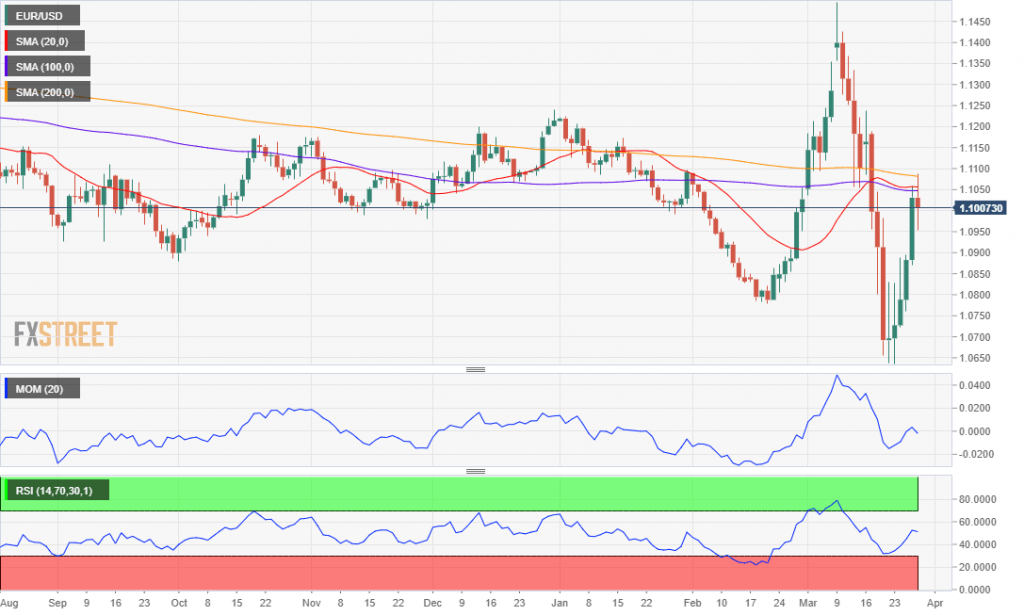

The EUR/USD pair has corrected higher, although the weekly rally stalled around the 50% retracement of its previous weekly slump. It’s finishing the week above the 38.2% retracement of such decline at 1.0960, an immediate support level.

In the long run, the risk remains skewed to the downside, as, in the weekly chart, the pair remains below all of its moving averages. The 100 SMA has crossed below the 200 SMA, both far above the current level. Technical indicators have recovered from their lows, but remain within negative levels. Consistent buying interest is yet to be seen.

The daily chart shows that the pair was unable to advance beyond its moving averages, which are now confined to a tight range. The Momentum indicator has resumed its decline near oversold readings, while the RSI lost directional strength within neutral levels, skewing the risk to the downside.

Below 1.0960, the next support comes at 1.0900, en route to 1.0835. Further declines could see the pair re-testing the mentioned low at 1.0635. Resistances these next few days come at 1.1090, the weekly high, followed by 1.1165, where the pair has the 61.8% retracement of its latest plunge. Gains beyond this last seem unlikely in a risk-averse environment.