- GBP/USD has been moving higher amid dollar weakness, amid concerns for PM Johnson.

- Various aspects of the leadership crisis may send sterling down again.

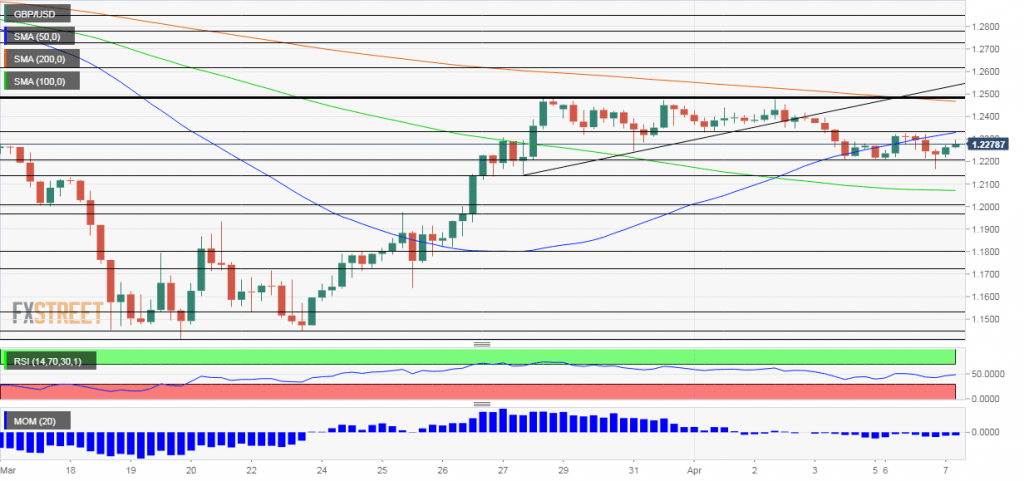

- Tuesday’s four-hour chart is pointing to further losses.

“Prime Minister Boris Johnson has been taken to intensive care” – push notifications from all news outlets jumped out late on Monday and sent the pound down. However, GBP/USD has recovered as the safe-haven dollar is under pressure amid encouraging coronavirus developments from other places in the world. A slowdown in the pace of new deaths and infections from Italy, Spain, France, and Germany sent stocks rising.

Nevertheless, the dramatic story worrying and may still take a heavier toll on the pound.

1) How is the PM doing? The news late on Monday came after hours of calming messages, that Johnson remains in charge of the government and that he is only in the hospital for tests. The most recent reports have suggested that he is receiving oxygen but is not on a ventilator. Hopefully, Tuesday’s information is more reliable than Monday’s. Nevertheless, being in intensive care is worrying enough.

MENUShow navigationFXStreet

![]() Yohay Elam

Yohay Elam

FXStreet Follow

GBP/USD Forecast: Five reasons why Boris’ ICU stay may hit the pound harder

ANALYSIS | Published Apr 07, 2020 07:15 (+00:00)

- GBP/USD has been moving higher amid dollar weakness, amid concerns for PM Johnson.

- Various aspects of the leadership crisis may send sterling down again.

- Tuesday’s four-hour chart is pointing to further losses.

“Prime Minister Boris Johnson has been taken to intensive care” – push notifications from all news outlets jumped out late on Monday and sent the pound down. However, GBP/USD has recovered as the safe-haven dollar is under pressure amid encouraging coronavirus developments from other places in the world. A slowdown in the pace of new deaths and infections from Italy, Spain, France, and Germany sent stocks rising.

Nevertheless, the dramatic story worrying and may still take a heavier toll on the pound.

1) How is the PM doing? The news late on Monday came after hours of calming messages, that Johnson remains in charge of the government and that he is only in the hospital for tests. The most recent reports have suggested that he is receiving oxygen but is not on a ventilator. Hopefully, Tuesday’s information is more reliable than Monday’s. Nevertheless, being in intensive care is worrying enough.

2) Leadership concerns: Johnson won a landslide majority in December and has consolidated his power. Any other leader would have less clout and would need to win over the trust of other ministers and civil servants while the country and the world are battling the coronavirus crisis.

3) Britain already in crisis: Johnson and his government were already criticized for handling COVID-19, initially letting the virus run. The PM abandoned the “herd immunity” policy and announced a lockdown, but the UK lacks sufficient testing. Contrary to several countries in the continent – that have suffered more than Britain but are seeming to turn a corner – the UK’s peak may still be ahead.

4) Hard-Brexit Raab: Foreign Secretary Dominic Raab is now in charge of the government. While the lawyer is seen as an intellectual within his party, he is not respected enough within the public. Raab is a staunch supporter of a hard exit from the EU, quitting then PM Theresa May’s government in anger after zigzagging. The Talks with the EU about future relations are now on hold and the UK is set to exit the transition period by year-end. The new man in charge may drive a harder exit, with less favorable trading terms for the UK.

5) Less stimulus: Putting Brexit aside, Raab leans toward more fiscally conservative views, contrary to the direction of Johnson and Rishi Sunak, Chancellor of the Exchequer. He may curb efforts to support workers and businesses and limit the pound’s recovery.

As mentioned earlier, GBP/USD is benefiting from the dollar’s weakness. Apart from improvements in Europe, hopes for additional fiscal stimulus in the US is also boosting sentiment and weighing on the US dollar. This may change later on.

Reports from St. Thomas hospital in central London – where Johnson is taken care of – are eyed and may overshadow any other news.

Pound/dollar is experiencing downside momentum on the four-hour chart and trades below the 50 and 200 Simple Moving Averages. However, it is still holding above the 100 SMA. All in all, bears are in the lead.

Support awaits at 1.205, which provided support on Friday. The next level to watch is 1.2140, which was a cushion in late March. The psychologically significant level of 1.20 and 1.1980 are next.

Resistance is at 1.2330, which capped cable on Monday. Further above, substantial resistance is at 1.2390, a stubborn cap from last week. 1.2610 is the next level to watch.