- USD/JPY rises moderately on risk aversion.

- Dollar improvement comes despite equity and Treasury yield declines.

- US NFP loss 0f 701,00 dominates statistics

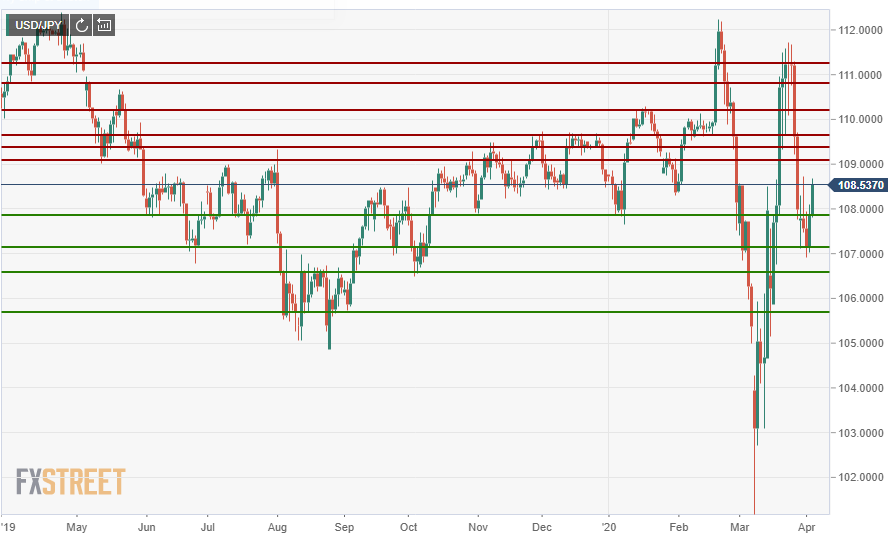

The US/JPY finished higher on the week, though it remains well below its peaks of mid and late March, as moderate risk aversion still orders markets. From Wednesday’s low of 106.92 the pair rose on Thursday and Friday to the high close at 108.54.

Once again the action and markets were almost exclusively US dollar based and driven by developments in the pandemic and its global economic repercussions.

American job numbers dominated the statistical week. The near record loss of 701,00 jobs last month, only the 800,000 plunge in March 2009 was greater, is the just the beginning as US job numbers track the nearly instantaneous labor market catastrophe prompted by the Coronavirus pandemic.

Currencies

The dollar maintained its position as the safety choice of markets as the difficult economic news from the United States and Europe took on concrete shape. On the week the US currency gained 0.5% versus the Japanese yen, 1.62% against the Canadian dollar, 3% against the euro and 2.8% versus the Australian dollar. Only in opposition to the British pound did it lose, 1.47%.

The USD/JPY is positioned between the extremes of 112.00 and 111.00 in the third weeks of February and March and the low of 103.00 on March 9 and 10. With that rapid and recent movement there is plentiful support and resistance lines to consider in periods of non-fundamental trading.

Equities

Dollar recovery also came despite global equity losses. Japanese equites equities dropped 8% from Friday to Friday, with the Nikkei 225 ending at 17,820.

US Stocks had another negative week on economic woes as he Dow dropped 360 points, 1.69% to 21,502 on Friday. It was down 2.7% on the week, its third losing week in four, and 26.2% on the year. It is 28.8% below its all-time high of 29,568 on February 12 of this year.

The S&P 500 finished off 1.51% for its third negative day in four. On the week the average lost 2.08% also its third down week in the last four. On the year it has shed 22.97% and is 26.66% below its record of 3,393.52 from February 19. Both averages could easily surpass 2008 as their worst year when the S&P lost 38.5% and the Dow 33.6%.

Bonds yields and WTI

Japanese sovereign rates were little changed on the week. The 10-year JGB closed on Friday March 27 at 0.013%, moved as high as 0.023% at Tuesday’s finish and ended the week at 0.003%.

Treasury yields in the US and commercial interest rates continued to slip as the Federal Reserve purchase program begun after the emergency March 15 meeting pushed bond prices higher and returns lower. The 10-year closed at 0.599% on Friday down from the 0.676% open on Monday. The 2-year yield lost 1 basis point on the week starting at 0.228% on Monday and finishing at 0.227% on Friday.

The average rate for a 30-year fixed mortgage dropped to 3.33% last week down 17 basis points. Together with the prior week’s decline it was the largest two-week decline since December 2008 when the Fed surprised the financial with its first-ever program buying mortgage-backed securities.

West Texas Intermediate (WTI, Clc1) had it best week in history record rising 31.75% and adding 11.93% on Friday finishing at $28.34. Nonetheless it remains down 53.59% on the year its worst performance since the start of this futures contract in 1983

Japanese statistics March 30–April 3

Tuesday

Japan’s unemployment rate was unchanged at 2.4% in February. The preliminary reading for industrial production (Y/Y) in February was -4.7% slightly better than the -5.5% forecast but still the fifth negative month in a row. On the month it rose 0.4% with a 0.1% predictions and a 1% gain in January. Retail trade rose 0.6% in February far ahead of the -0.9% projections, annual trade gained 1.7% on a -1.2% estimate.

Wednesday

The Tankan Survey from the Bank of Japan for the first quarter was better than forecast for large manufacturers’ outlook, -11 vs. -14, and in the index -8 vs -10, better for non-manufacturing industries in the index 8 vs 6, and worse in outlook at -1 vs 2. While the Tankan is a widely followed indicator the first quarter information is wholly out of date in the current situation.

Source from https://www.fxstreet.com/analysis/usd-jpy-forecast-will-the-news-get-worse-202004051845