- Australian inflation is foreseen well below the RBA’s target in Q1.

- RBA Trimmed Mean CPI is seen at 0.4% QoQ and 1.6% YoY, matching the previous figures.

- AUD/USD bullish, will continue to depend on the market’s sentiment.

The world paradigm has changed with the COVID-19 pandemic. Not only in the way of living, but also in what it’s relevant for economies. Before the coronavirus, a central bank kick-starting its printing machine was bad news. Inflation was among the most relevant macroeconomic indicators alongside employment figures, as central banks usually took monetary policy decisions based on those two main legs. Now, such a relationship is broken.

RBA’s economic concerns out of the picture

Macroeconomic data is relevant in the long-run, as we all hope the crisis will come to an end one day, and we would return to normal. Maybe a “new normal,” but normal at least. The immediate impact of data in currencies is distorted and will remain so, as long as the world gyrates around the pandemic. The accumulation of numbers will become to be relevant when economies start coming out of the woods.

That said, Australia is set to release quarterly inflation, seen at 0.2% in the first quarter of 2020, down from 0.7%. When compared to the first quarter of 2019, CPI is seen at 2.0% from 1.8%. The RBA Trimmed Mean CPI is seen at 0.4% and 1.6% respectively, unchanged from the previous quarter.

Australian low inflation has been a concern, and the RBA has been hesitating to introduce more facilities amid fears it would have a negative impact on the housing market. However, it seems now unlikely that the latest rate cuts to a record low of 0.25%, will boost the price of properties as it happened in the past.

In the meantime, the RBA continues to say that rates will remain low until inflation reaches the desired 2%-3% range and progress is seen toward full employment, quite unlikely in the current scenario.

AUD/USD Technical outlook

Unless the numbers diverge from expectations, it seems unlikely that AUD/USD will react to inflation figures, but instead, it will keep on moving alongside sentiment.

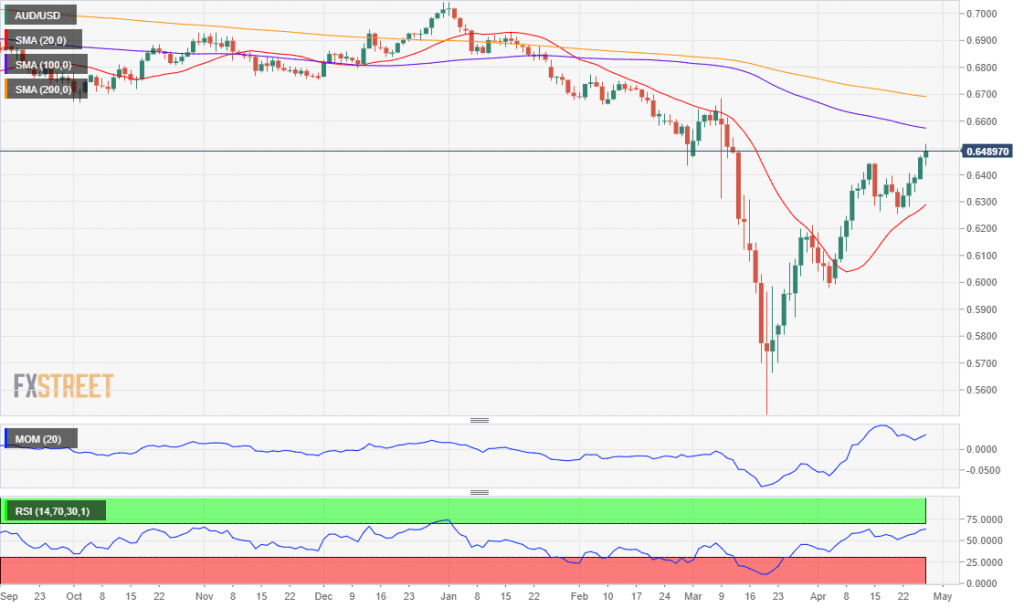

The pair is flirting with the 0.6500 figure ahead of the event and close to complete a V-shape reversal formation, clear int the daily chart. In the way, it would need to break above bearish 100 and 200 DMA, with the shortest providing dynamic resistance at 0.6570.

The pair is bullish, although without enough strength given that, in the mentioned chart, the Momentum indicator eases within positive levels while the RSI consolidates around 63. Still, as long as it holds above the 0.6400 figure, the risk will remain skewed to the downside. The immediate support is the former April monthly high at 0.6444.