EUR/USD is trading around 1.0850, higher amid an improved market mood. US first-quarter GDP is set to show a plunge in activity and German April CPI to reflect slower inflation. The Federal Reserve’s new projections are set to rock markets.

Euro/dollar has been confined to a range, with strong resistance awaiting at 1.0890, Tuesday’s top, the place where the 200 Simple Moving Average on the four-hour chart hits the price, and a resistance line from last week. It is followed by 1.0930, 1.0995, and 1.1050.

The bottom of the range is 1.0810, the low point on Tuesday and support line from mid-April. It is followed by 1.0770, 1.0730, and 1.0640.

Momentum is positive and the pair trades above the 50 SMA, yet below the 100 and 200 SMAs. All in all, the picture is mixed.

Gaining energy for a big move – the world’s most popular currency pair awaits 24 hours of top-tier events that may trigger high volatility.

The US publishes its initial estimate of Gross Domestic Product in the first quarter – providing a broad overview of coronavirus carnage. The economy likely contracted despite being shuttered only at the end of March. Personal consumption stands out as the primary component. Economists expect an annualized fall of 4%, the worst since the crisis, ahead of a double-digit squeeze in the second quarter.

See: US GDP Preview: Prelude to catastrophe or singularity?

The Federal Reserve probably already has the growth figures as it prepares to announce its decision later in the day. The world’s most powerful central bank will likely leave its policy unchanged but is set to publish new economic forecasts. It usually publishes projections in its March meeting, but officials skipped that planned event as they were busy providing stimulus throughout March.

The action included slashing rates to zero, launching unlimited Quantitative Easing, enacting swap lines with other central banks, and more. Only this week, the Fed has expanded its municipal bond-buying scheme. The Fed’s balance sheet is nearing $7 trillion.

Source: Federal Reserve

Jerome Powell, Chairman of the Federal Reserve, will hold a press conference in which he will likely reiterate his commitment to supporting the economy,y. However, markets are addicted to stimulus and may be disappointed without new announcements.

- Fed Preview: Taking a break after two months of madness? Addicted markets may fall, dollar rise

- Fed Preview: It’s all about the Projection Materials

European developments

The European Central Bank is scheduled to deliver its decision on Thursday, with growing pressure to expand its extraordinary Pandemic Emergency Purchasing Program (PEPP) currently worth €750 billion. Italy, the country hardest hit by the epidemic, continues struggling with its finances.

Italian bonds are under pressure after Fitch downgraded its credit rating to BBB-, just one notch above junk status, yet set a stable outlook. France and Spain both laid down detailed – and conditional – plans to exit their lockdowns throughout May and June.

Germany has suffered a setback, with growing infection rates that may force the continent’s largest economy to reimpose restrictions. Lifting lockdowns and then reinstating them not only postpones the return to normal economic activity but also deals a blow to consumer and business confidence.

Germany’s preliminary Consumer Price Index figures for April published on Wednesday will likely show a substantial downfall in inflation, potentially adding pressure on the ECB to act, yet it is divided along the same north-south lines as EU leaders.

See ECB Preview: The only game in town could be in lockdown, three mostly negative EUR/USD scenarios

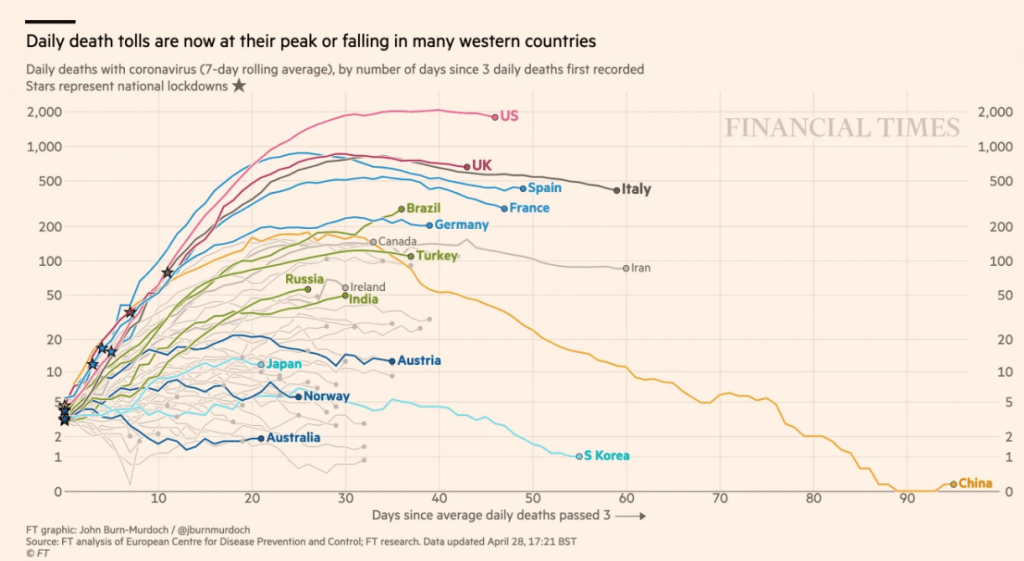

The spread of COVID-19 is slowing down in Europe and also in the US, and pressure is growing to reopen the economies. Policymakers have a hard time balancing between economic and health considerations. The two-week delay between taking measures and the effect on health systems further complicates the picture.

Source from https://www.fxstreet.com/currencies/eurusd