- GBP/USD has been struggling amid the ongoing UK lockdown, worrying economic figures.

- The focus shifts to the US, with the Fed and GDP standing out.

- Late April’s daily chart is painting a mixed picture.

- The FX Poll is pointing to lower targets, though with choppy movements.

Pound/dollar has been on the back foot as, despite a flattening curve, the shuttering of the economy is here to stay, and the economy is suffering badly. Events in the US are left, right, and center, with the first look at growth and the all-important Fed decision. Hopes for stimulus helped the currency pair recover, will it continue?

This week in GBP/USD: Uncertainty and depressing data

The pound has been mainly punished by uncertainty about the UK coronavirus situation. Deaths at hospitals are falling, yet at a slow pace. The total number of UK mortalities has leaped, suggesting the loss of life is greater. The country remains in lockdown through May 7 and, contrary to other countries – has no clear exit strategy.

Prime Minister Boris Johnson has been in touch with his colleagues as he continues recovering, but out of the public eyed. In his absence, Foreign Secretary Dominic Raab may hesitate to lead any change, especially as the government is coming under immense pressure.

The late response to the crisis and mismanagement of obtaining ventilators and gowns for doctors have dogged the executive branch. As parliament returned – using social distancing measures – Keir Starmer, the new Labour leader, has proved effective at criticizing the government.

Markit’s preliminary Purchasing Managers’ Indexes for April have plunged. The collapse of the Services PMI to a record low of 12.3 points is especially devastating. Other figures were more nuanced. The headline Consumer Price Index decelerated to 1.5% yearly in March, as expected, while jobless claims rose by a modest 12,100. Investors will have to wait for the next reports to see the true impact on the labor market.

The US dollar initially gained ground amid the crash in petrol prices. Technical quirks sent WTI crude oil to negative territory, yet even without irregularities, the massive lack of demand for energy amid the lockdowns is a reflection of the economic damage.

US data also disappointed and sent traders to the safety of the dollar – a classic risk-off response. Jobless claims topped four million, and Markit’s Services PMI plunged to 27 points. The heightened tensions between the US and China also weighed on the global mood, as many see an acceleration of the decoupling process, potentially hurting global trade and growth.

However, the greenback suffered some selling as reports suggested the Federal Reserve would expand its municipal bond-buying schemes, the Bank of Japan removed it’s Quantitative Easing limits. The EU seemed close to approving a large fiscal package. More stimulus of all sorts improved the mood and weighed on the greenback.

UK events: Lockdown speculation

As April draws to an end and May kicks off, the British government’s next steps regarding the shuttering of the economy will likely take center stage. The decision depends, first and foremost, on health figures. The curve needs to bend down, not only flatten.

If Johnson returns to Downing Street, that would be a boost to morale and could lift the pound. It would also help to publish and to approve an exit strategy and to provide more leadership. The removal of some uncertainty would also support the pound.

Brexit talks continue in the background and have yet to stir sterling. Any reports of disagreements could push the pound lower, while announcements of a breakthrough – which seem unlikely – may send investors to the pound.

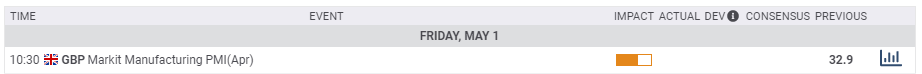

The only noteworthy release on the UK calendar is the final Manufacturing PMI, which will probably confirm fast contraction.

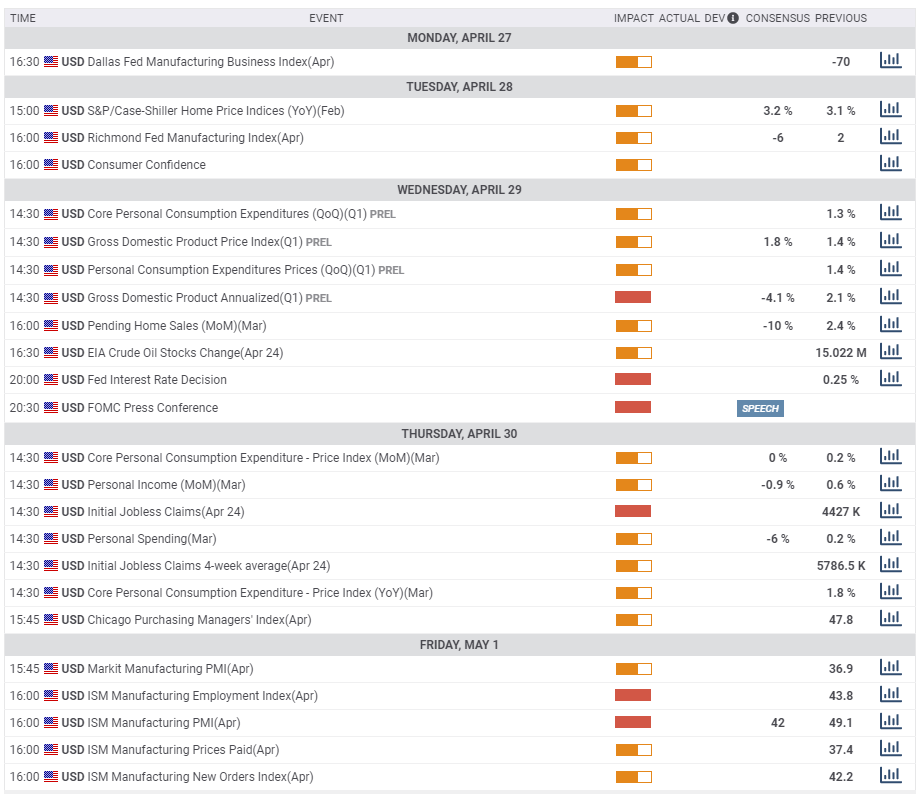

Here is the list of UK events from the FXStreet calendar:

US events: Two top-tier events and politics as well

As US COVID-19 statistics continue improving, the clash between President Donald Trump – who wants to reopen or “liberate” states – and governors will likely grow. Any decision to keep shelter-in-place orders take an economic and social toll, while easing restrictions too early may trigger a second wave of infections. If hospitals fill up again, lockdowns will return, dealing a deadly blow to consumer and investor confidence.

There are no easy choices. Better relations between various US authorities would boost sentiment and push the safe-haven dollar down, while clashes would cause confusion and support the king of cash.

The US economic calendar is packed with top-tier events. The Conference Board’s Consumer Confidence measure for April will likely reflect the recent economic hardship and crash. It serves as a warm-up to Wednesday’s top-tier events.

The world’s largest economy is forecast to report an annualized drop of 4.1% in Gross Domestic Product in the first quarter of 2020. That would be the worst since 2009 but only the tip fo the iceberg. The interruption to the economy came into effect only in mid-March, as jobless claims figures have shown.

Apart from the headline figure, investors will examine the fall in personal consumption as a critical factor, as America’s economy is centered on shopping.

The second crucial event on Wednesday is the Federal Reserve’s decision – the first scheduled one after deploying massive stimulus in response to the virus. The bank unleashed unlimited Quantitative Easing, set interest rates at zero, launched dollar swap lines with other central banks, and ventured into buying junk bonds. Jerome Powell, the Fed Chairman, may publish new forecasts for growth, employment, inflation, and interest rates. Gloomy forecasts mean lower rates for longer, but they may depress markets.

For more, see the full Fed Preview: Taking a break after two months of madness? Addicted markets may fall, dollar rise

The action continues with weekly jobless claims for the week ending April 24. Perhaps more importantly, Continuing Claims for the week ending April 17 – the week when Non-Farm Payrolls are held – will be of higher interest. An increase above 20 million ongoing applications cannot be ruled out.

Another hint towards the NFP comes on Friday with the ISM Manufacturing PMI for April. The headline figure is set to extend its fall within contraction territory, and the employment component will be in the limelight ahead of the jobs report.

GBP/USD Technical Analysis

Pound/dollar has been setting higher lows and higher highs – a bullish sign. On the other hand, upside momentum on the daily chart is waning and the currency pair trading below the 50, 100, and 200-day Simple Moving Averages. All in all, the picture is mixed.

Support awaits at 1.2250, the mid-April low. It is followed by the monthly trough of 1.2160, which is also the first cushion after prices stabilized. Further down, 1.1980 and 1.18 await cable.

Resistance is at 1.2405, which separated ranges during April. It is followed by the round 1.25 level, which capped GBP/USD in late March and is where the 50-day SMA hits the price. April’s peak of 1.2645 is the next level to watch, and it is followed by 1.2720.

GBP/USD Sentiment Poll

Growing evidence of the economic devastation will likely weigh on the global mood and support the dollar. Without a sharp fall in UK coronavirus figures, the pound will struggle to weather the storm.

The FXStreet Forecast Poll is pointing to falls in the short-term, a sideways move later and a bearish trend afterward. The average targets have not materially changed since the previous week.