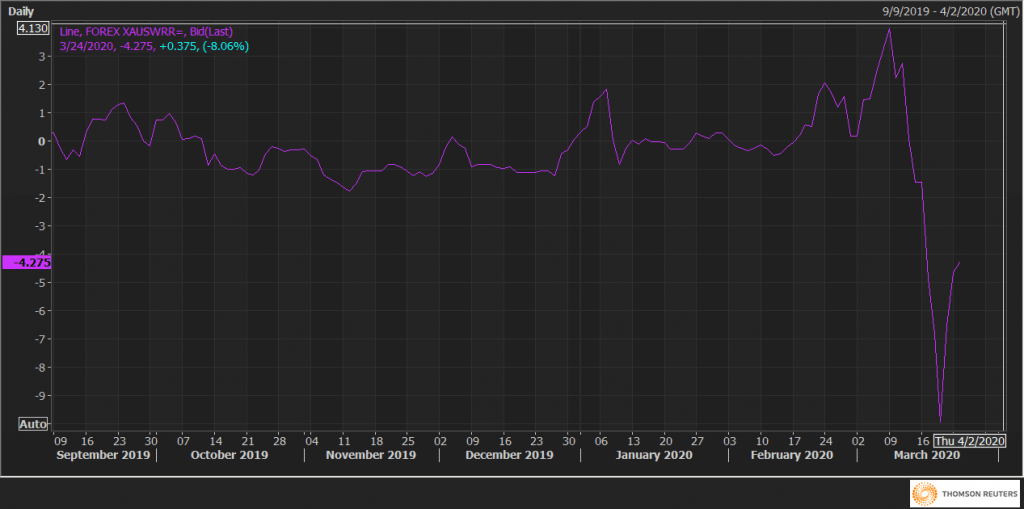

- Gold’s risk reversals rise, indicating a drop in demand for puts.

- The uptick validates the recovery rally in gold.

With gold rising for the third straight day, the options market is shedding the bearish bias on the yellow metal.

The anti-risk yellow metal is currently trading at $1,571 per Oz, representing a 1% gain on the day, having tested the 50-day average hurdle at $1,583 during the early Asian trading hours. Gold gained 3.7% and 1.89% on Monday and Friday, respectively.

Meanwhile, one-month risk reversals, a gauge of calls to puts, has risen to -4.3, having increased from -6.52 to -4.65 on Monday and hit a low of -9.925 on Friday.

The rise in the risk reversals represents a weakening demand or the implied volatility premium for the put options (bearish bets) and validates the recovery rally in prices. That said, the number remains negative, meaning the demand for puts is still greater than that for calls (bullish bets).

A put option gives the holder the right to sell gold at an agreed price on or before a particular date. A call option gives the holder the right to buy.

Source from https://www.fxstreet.com/news/gold-demand-for-put-options-drops-as-prices-rise-202003240347