Inflation is an economic term that refers to the rate at which the general level of prices for goods and services is increasing. When inflation occurs, the purchasing power of money decreases, and the cost of living goes up. In other words, you’ll need more money to buy the same goods and services you were able to purchase for less money before inflation.

The cost of living, on the other hand, is a broader term that includes all the expenses an individual or household incurs to maintain a certain standard of living. It includes expenses such as housing, food, healthcare, transportation, and more.

Inflation and the cost of living are intertwined, as inflation affects the cost of living in several ways. Here are some of the ways inflation can impact the cost of living:

- Higher prices for goods and services: When the rate of inflation goes up, the prices of goods and services tend to follow suit. This means that the cost of living increases, as it takes more money to buy the same goods and services.

- Decreased purchasing power: Inflation reduces the purchasing power of money. This means that the amount of goods and services you can buy with a certain amount of money decreases as inflation increases.

- Higher interest rates: When inflation goes up, the central bank may raise interest rates to combat inflation. This can lead to higher borrowing costs for individuals and businesses, which can increase the cost of living.

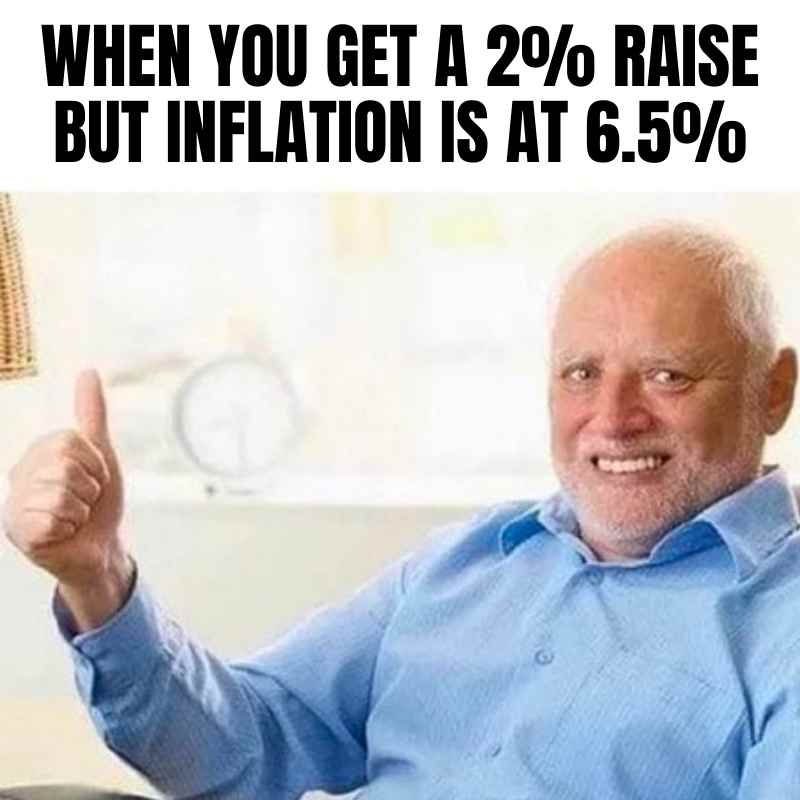

- Wage stagnation: If wages do not keep up with inflation, workers may find that their purchasing power decreases. This can make it harder to maintain the same standard of living, as it takes more money to buy the same goods and services.

Inflation and the cost of living can impact different individuals and households in different ways, depending on factors such as income, location, and lifestyle. For example, individuals with fixed incomes, such as retirees, may be more vulnerable to the effects of inflation, as they may not be able to increase their income to keep up with rising prices. Similarly, individuals in expensive cities may find that the cost of living is higher than in other areas.

To mitigate the impact of inflation and the cost of living, individuals can take several steps, such as:

- Budgeting: Creating a budget can help individuals track their expenses and prioritize their spending. This can help them make more informed decisions about how to allocate their resources.

- Saving: Building an emergency fund or saving for long-term goals can help individuals weather unexpected expenses or changes in their financial situation.

- Investing: Investing can be a way to grow wealth over time and keep up with inflation. However, it’s important to keep in mind that investing comes with risk and may not be suitable for everyone.

- Negotiating: When making major purchases or negotiating contracts, individuals can try to negotiate better prices or terms to help reduce their expenses.

In conclusion, inflation and the cost of living are important economic concepts that can impact individuals and households in significant ways. By understanding how they work and taking proactive steps to mitigate their impact, individuals can better manage their finances and maintain their standard of living over time.

For further information, contact me ,Gurmit at +60142584067, I will guide anyone who wants to register with Weltrade. You can register at the link below. Thank you.

https://my.weltrade.com/?r1=ipartner&r2=49989

Can join at our telegram group at Education and Signal , https://t.me/+NfCxZrhbyZIzMGI1

For traders who want to trade on their own can join Weltrade, we provide benefits for traders out there, learn to trade and follow free signals such as free paid signal providers, bookmap gold and tradingview premium live.

Free Bookmap Education t.me/+JetSe33YA0U2ZDk1

Join us at our zoom link, https://us06web.zoom.us/j/87503803695?pwd=UGxmeGpDc3BvK3JFK1NrRjlJQzVldz09 for online learning from 11.30 am to 12.30 am by the Financial Markets Research Center (FMRC) team, with Mr. Gurmit.