When it comes to trading in the stock market, there are two primary strategies: long-term and short-term. While both strategies have their advantages and disadvantages, choosing the right strategy for your investment goals and risk tolerance is essential for success in the market.

Long-Term Strategy:

A long-term strategy involves holding onto stocks for an extended period, usually several years, with the goal of benefiting from the stock’s growth over time. This strategy requires patience, discipline, and a strong understanding of a company’s long-term prospects and financials.

Advantages:

- Compound Interest: Long-term investors benefit from compound interest, which is the process of earning interest on interest. This means that over time, your investment grows faster as your earnings begin to earn money.

- Less Volatility: Long-term investing allows investors to ride out short-term fluctuations in the market, minimizing the impact of market volatility.

- Lower Taxes: Long-term investors are subject to lower capital gains tax rates compared to short-term traders.

Disadvantages:

- Slower Return on Investment: Long-term investing requires patience, and it may take several years before an investor sees a significant return on their investment.

- Limited Flexibility: Long-term investors cannot quickly respond to market changes or capitalize on short-term trading opportunities.

- Risk of Market Downturns: Long-term investing does not guarantee profits, and investors can suffer losses if the market experiences a significant downturn.

Short-Term Strategy:

A short-term strategy involves buying and selling stocks within a relatively short period, usually within a day or a few weeks, with the goal of making quick profits from short-term market movements. This strategy requires a strong understanding of technical analysis and a willingness to take on higher risk.

Advantages:

- Quick Profits: Short-term traders can capitalize on short-term market movements and make quick profits.

- High Flexibility: Short-term traders can quickly respond to market changes and capitalize on short-term trading opportunities.

- No Commitment: Short-term traders can quickly buy and sell stocks without the long-term commitment required by long-term investing.

Disadvantages:

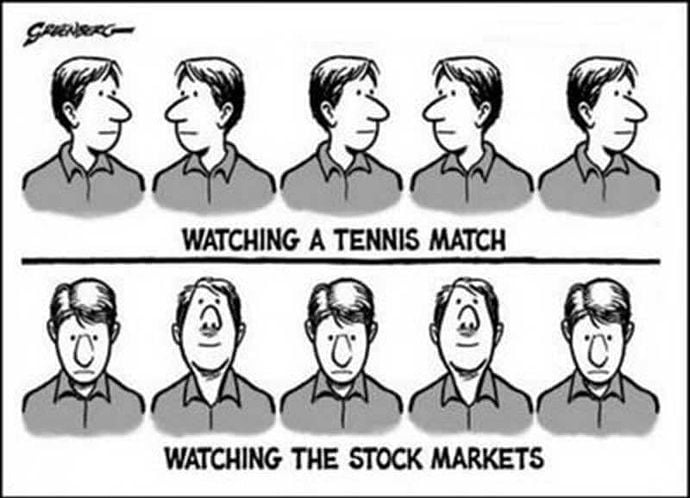

- Higher Risk: Short-term trading is riskier than long-term investing, as traders are exposed to higher volatility and uncertainty.

- Higher Taxes: Short-term traders are subject to higher capital gains tax rates compared to long-term investors.

- Requires Discipline: Short-term trading requires discipline and a strong understanding of technical analysis to identify short-term trading opportunities.

In conclusion, both long-term and short-term strategies have their advantages and disadvantages, and choosing the right strategy depends on your investment goals and risk tolerance. A long-term strategy can provide stable, long-term growth while a short-term strategy can provide quick profits but with higher risk. Ultimately, it’s important to find a strategy that aligns with your investment goals and risk tolerance and to stick to your plan through market ups and downs.

Anyone that wants to register with Weltrade, can contact me Gurmit at +60142584067 or click on the above astocard banner to register .

Can join at our telegram group at Education and Signal , https://t.me/+NfCxZrhbyZIzMGI1