- Yen improves as dollar risk premium ebbs.

- Lower volatility suggests markets awaiting direction.

- Economic comparisons will not aid the Japanese yen.

The global US dollar risk trade is still the primary motivator for currency movement but it is slowly wearing out as the pandemic loses its ability to frighten and analysis turns to the ability and willingness of countries to restart their economies.

Improvement for the yen was modest this week gaining a figure from 108.45 at the open on Monday to the Friday finish at 107.54 but it reflected the small shift in risk sentiment not a return to economic and interest rate comparisons.

Japan’s recent announcement of a month long state of emergency in Tokyo and six other hard-hit prefectures is not a western style lockdown. In all seven of the nation’s 47 prefectures are under rules that request residents to avoid all nonessential trips but are under no restrictions on travel. Violators cannot be punished unless the disobey orders related to emergency relief goods or medical supplies. Public schools in Tokyo and some neighboring areas are closed until at least May.

The bank of Japan’s $1 trillion (108 trillion yen) stimulus package is equal to about one fifth of Japanese annual GDP and includes payments to help businesses retain workers and cash grants to some households.

Even though the BOJ measures are far less than the efforts of the American Fed which has cut rates by 150 basis points to 0.25%, started a $700 billion bond purchase program and a $2.3 trillion loan program, all providing massive amounts of liquidity to the US economy, the negligible impact on the dollar speaks to the market concern for economic stability rather than a monetarist interest in currency supply and demand.

Japan statistics April 13-17

Japanese industrial production dropped 5.7% on the year in February for the fifth negative month in a row and a very poor starting point for the much larger declines coming in March and April. Monthly production fell 0.3% after January’s 0.4% gain. The Tertiary Index for the domestic service sector sank 0.5% in February as expected.

ENUShow navigationFXStreet

![]() Joseph Trevisani

Joseph Trevisani

FXStreet Follow

USD/JPY Forecast: Consolidation or the deep breath before the yen plunge?

ANALYSIS | Published Apr 19, 2020 22:06 (+00:00)

- Yen improves as dollar risk premium ebbs.

- Lower volatility suggests markets awaiting direction.

- Economic comparisons will not aid the Japanese yen.

The global US dollar risk trade is still the primary motivator for currency movement but it is slowly wearing out as the pandemic loses its ability to frighten and analysis turns to the ability and willingness of countries to restart their economies.

Improvement for the yen was modest this week gaining a figure from 108.45 at the open on Monday to the Friday finish at 107.54 but it reflected the small shift in risk sentiment not a return to economic and interest rate comparisons.

Japan’s recent announcement of a month long state of emergency in Tokyo and six other hard-hit prefectures is not a western style lockdown. In all seven of the nation’s 47 prefectures are under rules that request residents to avoid all nonessential trips but are under no restrictions on travel. Violators cannot be punished unless the disobey orders related to emergency relief goods or medical supplies. Public schools in Tokyo and some neighboring areas are closed until at least May.

The bank of Japan’s $1 trillion (108 trillion yen) stimulus package is equal to about one fifth of Japanese annual GDP and includes payments to help businesses retain workers and cash grants to some households.

Even though the BOJ measures are far less than the efforts of the American Fed which has cut rates by 150 basis points to 0.25%, started a $700 billion bond purchase program and a $2.3 trillion loan program, all providing massive amounts of liquidity to the US economy, the negligible impact on the dollar speaks to the market concern for economic stability rather than a monetarist interest in currency supply and demand.

Japan statistics April 13-17

Japanese industrial production dropped 5.7% on the year in February for the fifth negative month in a row and a very poor starting point for the much larger declines coming in March and April. Monthly production fell 0.3% after January’s 0.4% gain. The Tertiary Index for the domestic service sector sank 0.5% in February as expected.

FXStreet

Japanese statistics April 20-24

Monday

Imports are forecast to continue their dismal turn by falling 14.4% in March after dropping 13.9% in February and 3.5% in January. It would be the 11th straight month of contraction.

Exports are forecast to fade 4.3% after losing 1% in February. It would be the 16th negative month in a row.

Thursday

The Jibun Bank manufacturing PMI preliminary score for April will provide an early view of the pandemic impact on Japan’s factories. It was 44.8 in March.

National core CPI y/y for March expected to slip to 0.4% in March from 0.6% in February.

Japan statistics conclusion

The pandemic accounting for the Japanese economy has barely begun, that is one reason the yen has retained the minor buoyancy granted by the retreat of the risk trade. This will not last as the figures for March begin to unroll in the next few weeks. Japan’s position as a major investor in China and an export dominated economy will lead to a substantial decline in its economy.

USD/JPY outlook

The yen is in the odd place of benefiting from a reduction in risk aversion as long as it does not also bring a return to standard economic comparisons.

On terms of growth, dynamism and interest rate policy Japan and the yen will lose the discussion with the United States and the US dollar. In the immediate aspect the yen stands to gain against the dollar as the risk trade retreats but the longer view is decidedly negative for the Japanese economy and the currency.

US statistics April 13-17014

Wednesday

Retail sales in March were down 8.7% on the month below the 8% forecast but a good portion of that was lost automobile purchases as most dealerships in the country were closed. Sales ex-autos were off 4.5% slightly better than the -4.8% prediction. Industrial production fell 5.4% in March in its largest monthly decline on record. Capacity utilization plunged to 72.7% from 77% as many auto plants and other factories are closed. The New York Fed Empire State Manufacturing Survey crashed to-78.2 in March, its lowest ever, from -21.5 in February and though New York is no longer a major manufacturing center the reading is another tell for the American economy.

Thursday

Jobless claims remained the centerpiece in chronicling the economic cost of the government ordered pandemic shutdowns. Initial claims rose 5.245 million in the week of April 10 bringing the four week total to 22.03 million more than eight times the next highest total of 2.637 million in March 2009.

Sponsored byMENUShow navigationFXStreet

![]() Joseph Trevisani

Joseph Trevisani

FXStreet Follow

USD/JPY Forecast: Consolidation or the deep breath before the yen plunge?

ANALYSIS | Published Apr 19, 2020 22:06 (+00:00)

- Yen improves as dollar risk premium ebbs.

- Lower volatility suggests markets awaiting direction.

- Economic comparisons will not aid the Japanese yen.

The global US dollar risk trade is still the primary motivator for currency movement but it is slowly wearing out as the pandemic loses its ability to frighten and analysis turns to the ability and willingness of countries to restart their economies.

Improvement for the yen was modest this week gaining a figure from 108.45 at the open on Monday to the Friday finish at 107.54 but it reflected the small shift in risk sentiment not a return to economic and interest rate comparisons.

Japan’s recent announcement of a month long state of emergency in Tokyo and six other hard-hit prefectures is not a western style lockdown. In all seven of the nation’s 47 prefectures are under rules that request residents to avoid all nonessential trips but are under no restrictions on travel. Violators cannot be punished unless the disobey orders related to emergency relief goods or medical supplies. Public schools in Tokyo and some neighboring areas are closed until at least May.

The bank of Japan’s $1 trillion (108 trillion yen) stimulus package is equal to about one fifth of Japanese annual GDP and includes payments to help businesses retain workers and cash grants to some households.

Even though the BOJ measures are far less than the efforts of the American Fed which has cut rates by 150 basis points to 0.25%, started a $700 billion bond purchase program and a $2.3 trillion loan program, all providing massive amounts of liquidity to the US economy, the negligible impact on the dollar speaks to the market concern for economic stability rather than a monetarist interest in currency supply and demand.

Japan statistics April 13-17

Japanese industrial production dropped 5.7% on the year in February for the fifth negative month in a row and a very poor starting point for the much larger declines coming in March and April. Monthly production fell 0.3% after January’s 0.4% gain. The Tertiary Index for the domestic service sector sank 0.5% in February as expected.

FXStreet

Japanese statistics April 20-24

Monday

Imports are forecast to continue their dismal turn by falling 14.4% in March after dropping 13.9% in February and 3.5% in January. It would be the 11th straight month of contraction.

Exports are forecast to fade 4.3% after losing 1% in February. It would be the 16th negative month in a row.

Thursday

The Jibun Bank manufacturing PMI preliminary score for April will provide an early view of the pandemic impact on Japan’s factories. It was 44.8 in March.

National core CPI y/y for March expected to slip to 0.4% in March from 0.6% in February.

Japan statistics conclusion

The pandemic accounting for the Japanese economy has barely begun, that is one reason the yen has retained the minor buoyancy granted by the retreat of the risk trade. This will not last as the figures for March begin to unroll in the next few weeks. Japan’s position as a major investor in China and an export dominated economy will lead to a substantial decline in its economy.

FXStreet

USD/JPY outlook

The yen is in the odd place of benefiting from a reduction in risk aversion as long as it does not also bring a return to standard economic comparisons.

On terms of growth, dynamism and interest rate policy Japan and the yen will lose the discussion with the United States and the US dollar. In the immediate aspect the yen stands to gain against the dollar as the risk trade retreats but the longer view is decidedly negative for the Japanese economy and the currency.

US statistics April 13-17014

Wednesday

Retail sales in March were down 8.7% on the month below the 8% forecast but a good portion of that was lost automobile purchases as most dealerships in the country were closed. Sales ex-autos were off 4.5% slightly better than the -4.8% prediction. Industrial production fell 5.4% in March in its largest monthly decline on record. Capacity utilization plunged to 72.7% from 77% as many auto plants and other factories are closed. The New York Fed Empire State Manufacturing Survey crashed to-78.2 in March, its lowest ever, from -21.5 in February and though New York is no longer a major manufacturing center the reading is another tell for the American economy.

Thursday

Jobless claims remained the centerpiece in chronicling the economic cost of the government ordered pandemic shutdowns. Initial claims rose 5.245 million in the week of April 10 bringing the four week total to 22.03 million more than eight times the next highest total of 2.637 million in March 2009.

FXStreet

US statistics April 20-24

Tuesday

Existing home sales are about 90% of the US market. The forecast for March of an annualized rate of 5.4 million down from 5.77 million in February is probably too optimistic in light of the layoffs and shutdown in the second half of the month.

Thursday

Initial jobless claims have declined 24% in two weeks from 6.867 million (3/27) to 5.245 million (4/10), markets will be watching (and hoping) that this is the start of a trend. Preliminary April purchasing managers’ indexes from IHS Markit are forecast to remain in contraction, dropping to 42.8 in manufacturing from 48.5 and climbing to 42 from 39.8 in services. The Kansas City Fed Manufacturing Activity Index fort April will be released at 10:00 am EDT, March was -18.

Friday

Durable goods orders for March are expected to drop 11.2% after February’s 1.2% gain. Non-defense capital goods orders, the proxy for business spending, is projected to decrease 0.4% following February’s revised 0.9% drop.

The preliminary Michigan consumer sentiment for April is forecast to decrease to 67.2 from 71.

US statistics conclusion

Retail sales confirmed the the huge damage to consumption from the business shutdowns though almost half was due to automobiles. Initial claims moderated but the interest will be if the figures for the April 17 week confirm the downward trend on Thursday. Markit PMI numbers are normally a preliminary for the ISM surveys coming in the first part of May but in the current environment may gain trader attention on their own. Durable goods for March have been superseded by retail sales but the business investment proxy will provide some new information.

Markets have moved from initial shock of the unemployment claims numbers in the US to a more detailed enumeration of the economic collapse without changing the dire view into the second quarter. Confirmation of that outlook will tend to support the risk trade to the US dollar though with so much bad news already priced in, the opportunities for reversal are growing.

USD/JPY technical outlook

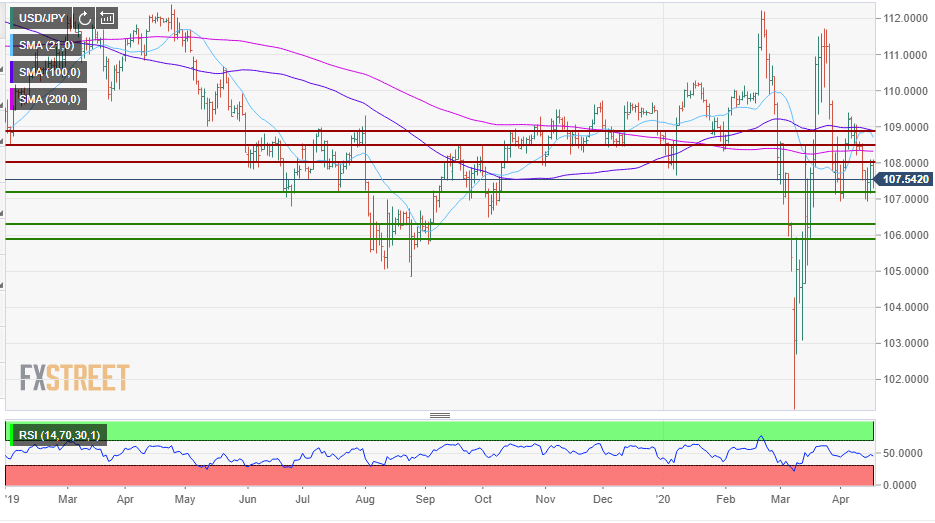

The relative strength index (RSI) is slightly negative from decline over the past two weeks but the variation this month has been small around the 50 neutral line.

All three of the moving averages have been crossed by the declining USD/JPY this month which in the near term predicts a weaker pair.

Support: 107.18; 106.28; 105.87

Resistance: 108.00: 108.50: 108.85