- USD/JPY volatility vanishes with 51 point daily average.

- Dollar seeking direction as risk trade pause continues.

- Pending economic statistics could reignite risk aversion.

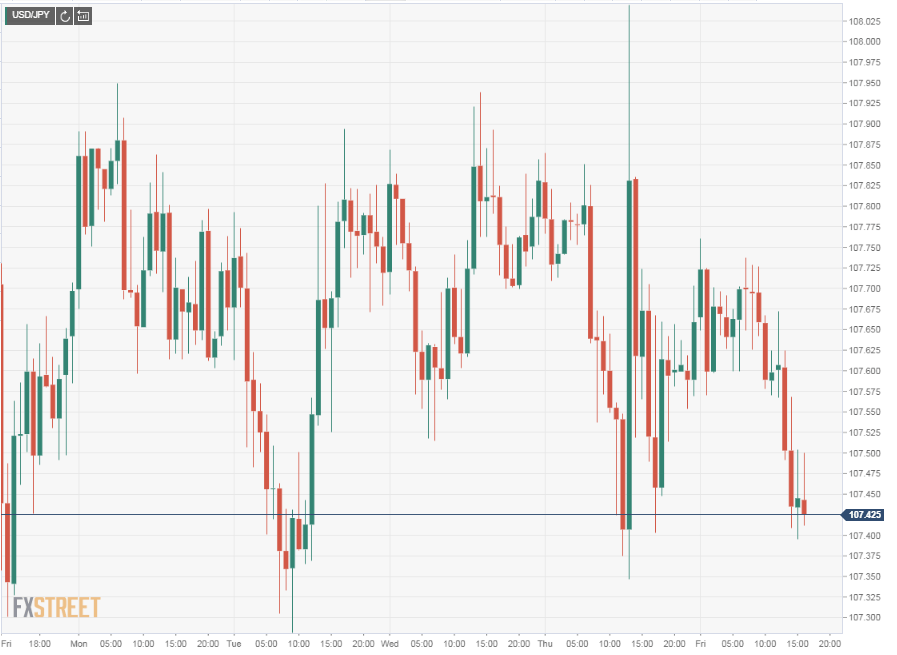

The USD/JPY had its calmest week since the pandemic exploded in the currency markets in mid-February. The pair opened at 107.54 on Monday and finished at almost the same rate on Friday, 107.44. In five sessions the daily range was 51 points, its lowest volatility since trading an average of 25 points a day in the week of February 10.

Coronavirus reporting did not impact trading this week as cases and fatalities seemed to be ebbing in many countries and several including the US, Germany and Austria were considering options and timetables for a slow reopening their economies.

The Bank of Japan (BOJ) announcement on Thursday that it would take up the topic of unlimited bond buying at its April 27 meeting spurred a brief 60 point run higher to 108.05 early in the New York session but by the close at 107.58 all but about 20 points had dissipated.

USD/JPY outlook

Markets are a long way from returning to traditional economic comparisons

The gradual and limited improvement in the yen this week is not a reflection of a shifting comparison between the Japanese and American economies or the policies of their central banks. It is a simple wearing away of the risk trade premium of the US dollar as pandemic fears habituate and economic statistics, at least in the US, have already delivered their damaging blows.

As long as no new cause for excitation arises the slippage of the USD/JPY should continue.

A reignition of the risk trade and a rise in the USD/JPY if the pandemic worsens remains a possibility. A substantial rise in cases and fatalities in the European countries and American states that are beginning to restart commercial life would be the most likely catalyst.

Japanese statistics April 20-24

Japanese economic statistics were generally weaker than forecast but not greatly so and except for the March numbers for the Jibun manufacturing PMI and imports and exports listed February information.

Imports in March fell 5%, much less than the -14.4% projection and the -13.9% result in February but it was the 11th straight month of decline. Exports fell 11.7% on the month, more than double the -4.3% prediction. They were down 1% in February and have contracted for 16 straight months. With the full impact of the global economic slowdown

The preliminary Jibun Bank Manufacturing PMI for April came in at 43.7 down from 44.8 in March and the 12th month in a row below 50 and the lowest reading of the run. It is the lowest this gauge of business and economic conditions in the factor sector has been since April 2009.

The Coincident Index for February from the Cabinet Office which tracks the overall health of the economy registered 95.5 missing the 95.8 estimate and January’s 95.7 reading. The February Leading Economic Index for February at 91.7 was higher than the January score of 90.7 but still at the low end of the two year fall from 105.9 in January 20018.

Overall CPI was 0.4% on the year in March down from 0.6% in February and the core annual rate was unchanged at 0.6%.

Japanese statistics April 27-May 1

Monday

The unemployment rate in March is expected to rise 0.1% to 2.5%. Japan’s declining population and relative scarcity of young workers should keep the jobless rate low even if the global economic slowdown cuts into manufacturing output.

The Bank of Japan will leave the overnight rate unchanged at -0.1% where it has been for four years. The bank said it will discuss unlimited bond purchases at this meeting but even if they decide to increase their holdings the market impact will be limited. Japan has had negative rates since January 2016, forcing them deeper will have little economic effect.

Wednesday

March retail trade or sales is expected to be down 4.7% on the year after Februarys 1.6% gain. Industrial production should post a 5.2% decline in March which would be its largest since January 2018. On the year production was down 5.7% in February.

Thursday

Housing starts are forecast to decrease 16% in March after Februarys 12.3% fall. It would be their 12th straight decline.

Japan statistics conclusion

The impact of the global slowdown is beginning to be felt in the Japanese economy. The March drop in exports will likely accelerate in April and industrial production post its biggest decline in two years. Bank of Japan monetary policy has been at a stand for years and there is little expectation that larger bond purchases will suffice to counter the contraction in GDP brought on by the global response to the Coronavirus.

American statistics April 20-24

Tuesday

Existing home sales, 90% of the US housing market fell 8.5% to a 5.27 million annualized rate with many sellers pulling properties to await better conditions

Thursday

Initial jobless claims were 4.4 million in the week of April 10 bringing the total newly unemployed to just over 26 million in five weeks though they are down 36% from their high of three weeks ago.

The preliminary IHS Markit purchasing managers’ indexes for April came in at 36.9 and 27 respectively, by far the lowest reading in the brief history of this series.

The Kansas City Fed Manufacturing Activity Index for April plunged to -62 from-18 in March, its worst level since the financial crisis.

Friday

Durable goods orders in March crashed 14.4% a bit worse than the -11.9% forecast but ex-transport orders were only down 0.2% on a -5.8% estimate and core capital goods orders rose 0.1% on a -6% predictions.

Michigan consumer sentiment for April was revised slightly higher to 71.8 from 71, a slip to 68 had been forecast.

US statistics April 27-May 1

Wednesday

First quarter GDP is expected to be negative at -4% driven down by the spectacular collapse in economic activity in March after running at about 2.7% in the January and February as estimated by the Atlanta Fed.

Thursday

Initial jobless claims for the week of April 17 are forecast to be 3.5 million which would be a a 50% decline from the 6.867 peak on March 27.

Personal income in March should drop 1.4% following February’s 0.6% increase. Core PCE inflation will slip 0.2% to 1.6% and the headline index 0.1% to 1.7%.

Friday

The purchasing managers’ index for the manufacturing sector from the Institute for Supply Management is forecast to pitch to 36.7 in April from 49.1 in February. It would be the lowest score since March 2009.

Sponsored byMENUShow navigationFXStreet

![]() Joseph Trevisani

Joseph Trevisani

FXStreet Follow

USD/JPY Forecast: This consolidation has no future

ANALYSIS | Published Apr 24, 2020 17:07 (+00:00)

- USD/JPY volatility vanishes with 51 point daily average.

- Dollar seeking direction as risk trade pause continues.

- Pending economic statistics could reignite risk aversion.

The USD/JPY had its calmest week since the pandemic exploded in the currency markets in mid-February. The pair opened at 107.54 on Monday and finished at almost the same rate on Friday, 107.44. In five sessions the daily range was 51 points, its lowest volatility since trading an average of 25 points a day in the week of February 10.

Coronavirus reporting did not impact trading this week as cases and fatalities seemed to be ebbing in many countries and several including the US, Germany and Austria were considering options and timetables for a slow reopening their economies.

The Bank of Japan (BOJ) announcement on Thursday that it would take up the topic of unlimited bond buying at its April 27 meeting spurred a brief 60 point run higher to 108.05 early in the New York session but by the close at 107.58 all but about 20 points had dissipated.

USD/JPY outlook

Markets are a long way from returning to traditional economic comparisons

The gradual and limited improvement in the yen this week is not a reflection of a shifting comparison between the Japanese and American economies or the policies of their central banks. It is a simple wearing away of the risk trade premium of the US dollar as pandemic fears habituate and economic statistics, at least in the US, have already delivered their damaging blows.

As long as no new cause for excitation arises the slippage of the USD/JPY should continue.

A reignition of the risk trade and a rise in the USD/JPY if the pandemic worsens remains a possibility. A substantial rise in cases and fatalities in the European countries and American states that are beginning to restart commercial life would be the most likely catalyst.

Japanese statistics April 20-24

Japanese economic statistics were generally weaker than forecast but not greatly so and except for the March numbers for the Jibun manufacturing PMI and imports and exports listed February information.

Imports in March fell 5%, much less than the -14.4% projection and the -13.9% result in February but it was the 11th straight month of decline. Exports fell 11.7% on the month, more than double the -4.3% prediction. They were down 1% in February and have contracted for 16 straight months. With the full impact of the global economic slowdown

The preliminary Jibun Bank Manufacturing PMI for April came in at 43.7 down from 44.8 in March and the 12th month in a row below 50 and the lowest reading of the run. It is the lowest this gauge of business and economic conditions in the factor sector has been since April 2009.

The Coincident Index for February from the Cabinet Office which tracks the overall health of the economy registered 95.5 missing the 95.8 estimate and January’s 95.7 reading. The February Leading Economic Index for February at 91.7 was higher than the January score of 90.7 but still at the low end of the two year fall from 105.9 in January 20018.

Overall CPI was 0.4% on the year in March down from 0.6% in February and the core annual rate was unchanged at 0.6%.

Japanese statistics April 27-May 1

Monday

The unemployment rate in March is expected to rise 0.1% to 2.5%. Japan’s declining population and relative scarcity of young workers should keep the jobless rate low even if the global economic slowdown cuts into manufacturing output.

The Bank of Japan will leave the overnight rate unchanged at -0.1% where it has been for four years. The bank said it will discuss unlimited bond purchases at this meeting but even if they decide to increase their holdings the market impact will be limited. Japan has had negative rates since January 2016, forcing them deeper will have little economic effect.

Wednesday

March retail trade or sales is expected to be down 4.7% on the year after Februarys 1.6% gain. Industrial production should post a 5.2% decline in March which would be its largest since January 2018. On the year production was down 5.7% in February.

Thursday

Housing starts are forecast to decrease 16% in March after Februarys 12.3% fall. It would be their 12th straight decline.

Japan statistics conclusion

The impact of the global slowdown is beginning to be felt in the Japanese economy. The March drop in exports will likely accelerate in April and industrial production post its biggest decline in two years. Bank of Japan monetary policy has been at a stand for years and there is little expectation that larger bond purchases will suffice to counter the contraction in GDP brought on by the global response to the Coronavirus.

FXStreet

American statistics April 20-24

Tuesday

Existing home sales, 90% of the US housing market fell 8.5% to a 5.27 million annualized rate with many sellers pulling properties to await better conditions

Thursday

Initial jobless claims were 4.4 million in the week of April 10 bringing the total newly unemployed to just over 26 million in five weeks though they are down 36% from their high of three weeks ago.

The preliminary IHS Markit purchasing managers’ indexes for April came in at 36.9 and 27 respectively, by far the lowest reading in the brief history of this series.

The Kansas City Fed Manufacturing Activity Index for April plunged to -62 from-18 in March, its worst level since the financial crisis.

Friday

Durable goods orders in March crashed 14.4% a bit worse than the -11.9% forecast but ex-transport orders were only down 0.2% on a -5.8% estimate and core capital goods orders rose 0.1% on a -6% predictions.

Michigan consumer sentiment for April was revised slightly higher to 71.8 from 71, a slip to 68 had been forecast.

FXStreet

US statistics April 27-May 1

Wednesday

First quarter GDP is expected to be negative at -4% driven down by the spectacular collapse in economic activity in March after running at about 2.7% in the January and February as estimated by the Atlanta Fed.

Thursday

Initial jobless claims for the week of April 17 are forecast to be 3.5 million which would be a a 50% decline from the 6.867 peak on March 27.

Personal income in March should drop 1.4% following February’s 0.6% increase. Core PCE inflation will slip 0.2% to 1.6% and the headline index 0.1% to 1.7%.

Friday

The purchasing managers’ index for the manufacturing sector from the Institute for Supply Management is forecast to pitch to 36.7 in April from 49.1 in February. It would be the lowest score since March 2009.

US statistics conclusion

The labor market continued to dominate market perceptions. Having raised the bar for disaster to such extraordinary levels other data, like durable goods orders and home sales or the April non-farm payrolls, that might be expected to drive trading had or will have little impact.

In the week ahead initial and continuing claims remain center stage. The forecast 50% decline will not be taken as good news given that it will bring the six week unemployment total to nearly 30 million. Likewise manufacturing PMI even if worse than predicted will have small import, though a better than expected number should be mildly positive for equities.

USD/JPY technical outlook

The static USD/JPY this week was enough, in the context of the decline from over 109.00 two weeks ago , to bring the relative strength index to just below neutral. The 200-day average is flat as the price action of the last six months is nearly symmetric in effect if not in range. The shorter terms bear the downward tilt of the fall from almost 111.72 over the past month.

Resistance: 108.00; 108.53; 109.00; 109.60; 110.15

Support: 107.00: 106.75; 106.50; 105.50; 105.10

Source from https://www.fxstreet.com/analysis/usd-jpy-forecast-this-consolidation-has-no-future-202004241707