- GBP/USD climbed to four-week tops on Friday, albeit failed to capitalize.

- A subdued USD demand, Johnson’s improving condition remained supportive.

The GBP/USD pair consolidated its recent move up to four-week tops and oscillated in a narrow trading band amid holiday-thinned liquidity conditions on Good Friday. The British pound was being supported by reports that the UK Prime Minister Borish Johnson had moved out of the intensive care. On the other hand, the US dollar was being weighed down by the Fed’s announcement on Thursday to provide up to $2.3 trillion of additional loans to support the economy.

The USD remained depressed following the release of softer-than-expected US consumer inflation figures, which showed that the headline CPI fell by the most in more than five years and contracted 0.4% in March. Meanwhile, the yearly rate eased to 1.5% and recorded the smallest advance since February 2019. Bulls, however, failed to capitalize on the supporting factors and refrained from placing any aggressive bets on persistent worries over the economic fallout from the coronavirus pandemic.

The pair finally settled around mid-1.2400s and managed to regain some positive traction on the first day of a new trading week amid persistent USD selling bias. In the absence of any major market-moving economic releases, either from the UK or the US, developments surrounding the coronavirus saga might influence the USD price dynamics and produce some meaningful trading opportunities.

Short-term technical outlook

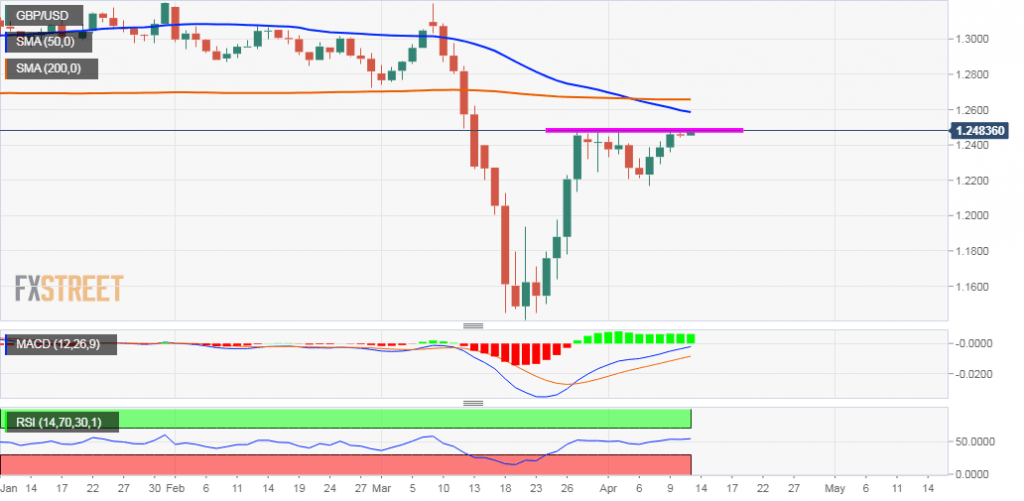

From a technical perspective, any subsequent strength beyond the key 1.2500 psychological mark could get extended towards 50-day SMA, around the 1.2585 region. Some follow-through buying will negate any near-term bearish bias and trigger a fresh bout of the short-covering move, which should assist the pair to amid towards testing the very important 200-day SMA, around the 1.2665-70 region.

On the flip side, the 1.2410-1.2400 region is likely to protect the immediate downside, which if broken might turn the pair vulnerable to accelerate the slide further towards the 1.2330-25 support area. This is closely followed by the 1.2300 round-figure mark, which if broken might turn the pair vulnerable to fall back towards challenging the 1.2200 mark.