USD/JPY Current price: 107.42

- US March Retail Sales expected to have fallen by 8.0%, partially reflecting the ongoing crisis.

- Concerns about a global recession weighing on the market’s mood, equities down.

- USD/JPY recovering within range, upside capped by Fibonacci resistance at 107.70.

ENUShow navigationFXStreet

![]() Valeria Bednarik

Valeria Bednarik

FXStreet Follow

USD/JPY Forecast: Dollar demand returns, upside limited

ANALYSIS | Published Apr 15, 2020 10:20 (+00:00)

USD/JPY Current price: 107.42

- US March Retail Sales expected to have fallen by 8.0%, partially reflecting the ongoing crisis.

- Concerns about a global recession weighing on the market’s mood, equities down.

- USD/JPY recovering within range, upside capped by Fibonacci resistance at 107.70.

The tide turned this Wednesday, and the dollar is appreciating against all of its major rivals. There was no particular catalyst behind the move, although the sour tone of equities in Asian and Europe surely fuels demand for the safe-haven dollar. Wall Street closed in the green on Tuesday, despite earnings season kick-started with JP Morgan reporting net income was down 69%, while earnings per share were down roughly 70%. Several big names have anticipated that the severe downturn triggered by the coronavirus pandemic could wipe out yearly revenues.

The USD/JPY pair recovered from sub-107.00 and hit a daily high of 107.51, as the market is all about the greenback ever since the pandemic began hurting economies. The bullish potential is being limited by Treasury yields, which fell sharply on the back of mounting concerns about a global recession.

The Japanese macroeconomic calendar had nothing to offer at the beginning of the day. The US calendar will be a bit more interesting, as the country will release March Retail Sales. The number will partially include the effects of the lock-down of some states, and sales are expected to have decreased by 8.0%. The country will also release MBA Mortgage Applications for the week ended April 10 and the NY Empire State Manufacturing Index for April, foreseen at -35 from -21.5 previously. Finally, the US will publish March Industrial Production, foreseen down by 4.0%.

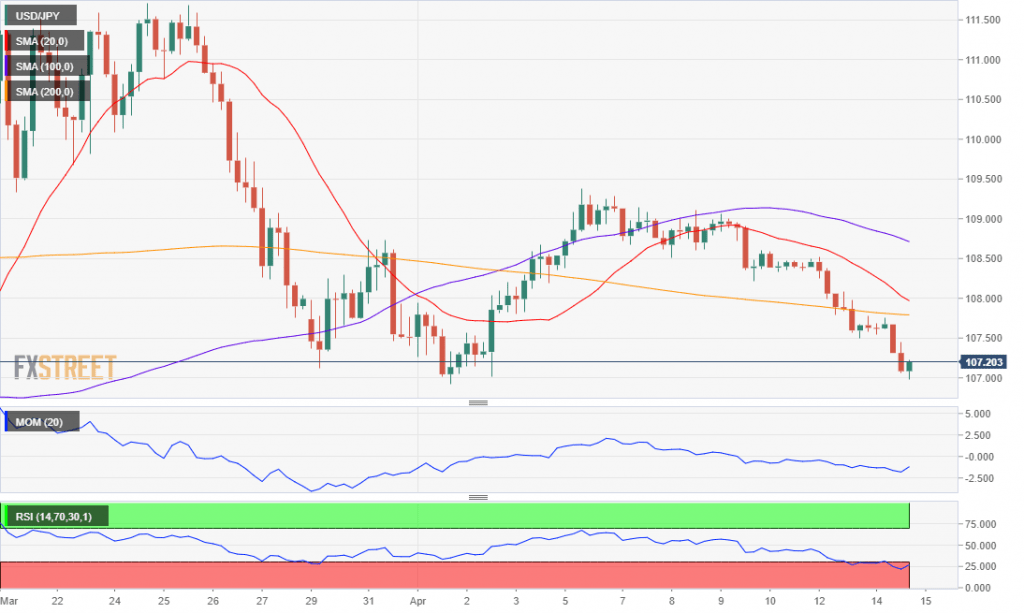

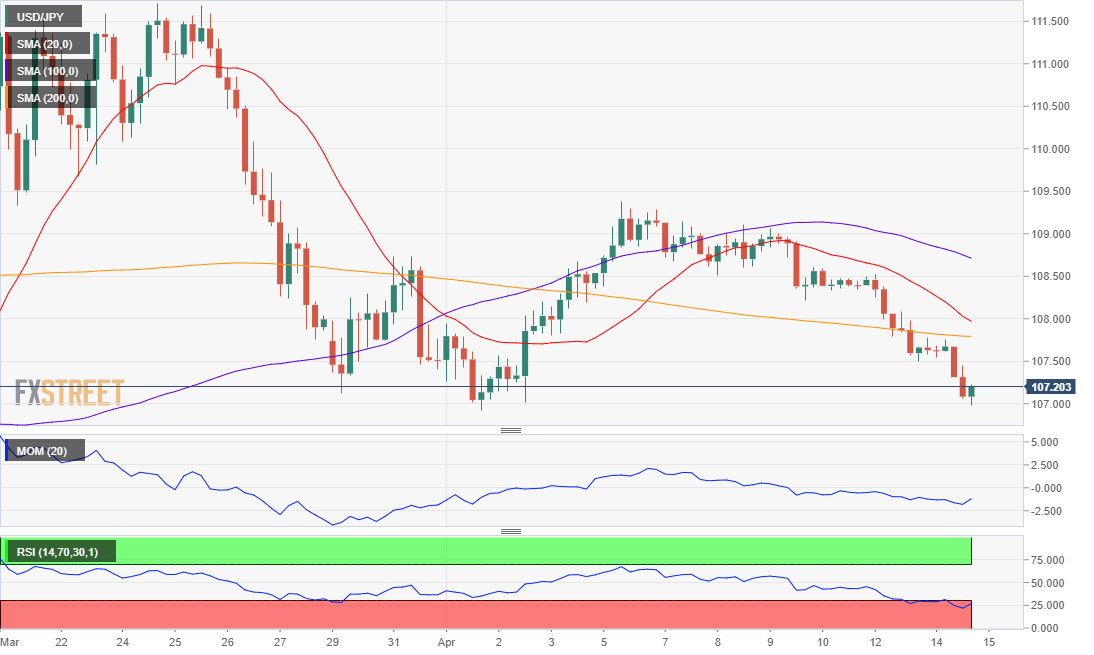

USD/JPY short-term technical outlook

The USD/JPY pair trades near its daily high, just below a relevant Fibonacci level at 107.70, the immediate resistance. In the 4-hour chart, the pair is developing below all of its moving averages, with the 20 and 200 SMA converging just above the mentioned Fibonacci resistance. Technical indicators, in the meantime, have bounced modestly from their weekly lows, but continue to lack upward strength within negative levels.

Support levels: 106.95 106.50 106.15

Resistance levels: 107.70 108.10 108.50

Source from https://www.fxstreet.com/analysis/usd-jpy-forecast-dollar-demand-returns-upside-limited-202004151020